The Indonesian taxation system is designed to ensure that all individuals and entities who are tax residents contribute to the nation’s development through taxes. A pivotal element of this system is the NPWP (Nomor Pokok Wajib Pajak), or the Tax Identification Number in Indonesia.

The 15-digit NPWP card is not just an identity marker but also a legal requirement for those engaged in taxable activities within Indonesia. The tax card-NPWP serves multiple purposes: it acts as an identifier for taxpayers, enabling the Directorate General of Taxes (DGT) to track tax payment histories and ensure compliance with tax regulations.

The requirement to obtain an NPWP applies to various categories of taxpayers:

- Individuals: Any resident earning an income above the non-taxable threshold (PTKP) must register for an NPWP, including employees, self-employed individuals, freelancers, and professionals.

- Businesses: All businesses, including corporations, partnerships, and sole proprietorships, must obtain an NPWP. This requirement also extends to foreign companies operating in Indonesia.

- Other entities: Non-profit organizations, foundations, and associations should register for an NPWP if they engage in taxable activities.

For individuals, whether Indonesian citizens or expatriates, the NPWP (Taxpayer Identification Number) is mandatory if they reside in Indonesia for more than 183 days within 12 months or intend to establish residency in the country. It is also required for individuals earning above a specified threshold, receiving income from multiple sources, or engaging in self-employment and business activities.

For companies, possessing an NPWP is equally crucial. It serves as the identifier for corporate taxes and is essential for foreign entities such as foreign investment companies operating in Indonesia. This tax ID number facilitates the timely payment of monthly income taxes, the annual filing of taxes, and the reporting of income earned outside Indonesia.

Furthermore, it plays a vital role in promoting financial transparency and accountability, which are fundamental for economic stability.

Also Read: Aturan Tax Treaty pada Perhitungan PPh 26 Wajib Pajak Luar Negeri

Responsibilities of NPWP holders

Holding an NPWP comes with several responsibilities:

- Filing tax returns: NPWP holders must file annual tax returns and report their income and expenses for the year.

- Paying taxes: Taxpayers are required to pay any taxes owed based on their reported income. This may include personal income tax, corporate tax, value-added tax (VAT), and other applicable taxes.

- Record keeping: Proper record-keeping is essential for tax compliance in Indonesia. NPWP holders must maintain accurate records of their financial transactions, receipts, and other relevant documents.

- Timely compliance: Taxpayers should complete all tax filings and payments within the deadlines set by the DGT to avoid penalties and interest charges.

Single Identification Number

The integration of NPWP (Taxpayer Identification Number) and NIK (Nomor Induk Kependudukan) marks a significant advancement in streamlining administrative processes in Indonesia. This initiative aims to support the ‘One Data Indonesia’ policy, which seeks to simplify tax administration and improve public service delivery.

This integration is a key component of the broader Harmonization of Tax Regulations Law (UU HPP), as stipulated by Law Number 7 of 20211. Subsequent regulations, including Presidential Regulation Number 83 of 20212 and Ministry of Finance Regulation No. 112/PMK.03/20223, provide the procedural details and legal framework for this unification.

Effective July 14, 2022, taxpayers with a 15-digit NPWP can utilize their NIK as their tax identification number, subject to a matching process based on taxpayer requests. This procedure involves verifying personal data against population records maintained by the Ministry of Home Affairs through the Directorate General of Population and Civil Registration.

The integration process for individual taxpayers categorizes results into two groups: valid data, which aligns with population records, and invalid data, requiring further details. Taxpayers with invalid data must provide additional information such as email addresses, phone numbers, accurate residential addresses, business field classifications (KLU), and family unit data.

This integration paves the way for the adoption of a Single Identification Number (SIN) system in Indonesia. Starting July 1, 2024, the NIK will serve as the NPWP for resident individual taxpayers, while non-residents, entities, and government institutions will use a 16-digit NPWP.

This single identifier is expected to streamline taxpayer data synchronization, verification, and validation, simplifying tax compliance in Indonesia for citizens. Taxpayers can self-integrate or validate their information through the official tax website, pajak.go.id, by logging in with their NPWP, entering their NIK, verifying its accuracy, and updating their profile. This process underscores the government’s commitment to an effective and efficient tax administration system.

As of the latest updates, 81% of individual taxpayers have successfully matched their NIK with their NPWP. The deadline for completing this unification was set before January 1, 2024, emphasizing the urgency for taxpayers to comply with the new regulations.

The unification of NPWP and NIK represents a transformative step toward modernizing tax administration, reducing bureaucracy, and promoting transparency and ease of doing business in Indonesia.

Obtaining a Tax Identification Number (TIN Indonesia)

The process of obtaining an NPWP is straightforward but requires attention to detail. Applicants must provide a completed registration form, passport details, work permits, and other relevant documents to the tax office.

Registering for an NPWP in Indonesia is now more accessible thanks to the online services provided by the Directorate General of Taxes. However, if you cannot go online, you can also visit the nearest tax office for a direct application.

Here is a detailed guide on how to obtain an NPWP online and offline:

Online registration

- Prepare the necessary documents: Before you begin the online registration, ensure you have all the required documents ready. These include a valid ID Card (Kartu Tanda Penduduk or KTP) for Indonesian citizens or a passport and residency permit (KITAS/KITAP) for foreigners.

- Access the Directorate General of Taxes website: Visit the official Directorate General of Taxes website to access the NPWP registration portal.

- Complete the registration form: Fill out the online registration form with accurate personal data and upload the necessary documents.

- Document verification: After submitting the form, your documents will undergo a verification process.

- Receive your NPWP number: Once your application is verified, you will receive your NPWP number, which you can use for all tax-related activities.

Offline registration

- Visit the nearest tax office: For offline registration, visit your nearest tax office with all the required documents (KTP for Indonesian citizens or passport and residency permit for foreigners).

- Fill out the application form: Complete the application form provided by the tax office correctly.

- Submit your documents: Hand in your documents for verification.

- Wait for the verification process: The tax office will verify your documents and process your application.

- Receive your NPWP tax card: Once your application is approved, you will be issued an NPWP card that you can use for tax purposes.

Also Read: The Benefits of Using Payroll Outsourcing Services in Indonesia

The importance and benefits of NPWP

The NPWP is more than just a number; it is a key to unlocking numerous benefits that facilitate a smoother and more compliant financial experience in Indonesia. Here, we delve into the benefits of obtaining an NPWP for personal and corporate entities.

- Tax compliance in Indonesia: The NPWP is a critical tool for tax authorities to monitor and enforce tax compliance in Indonesia. By having a unique identifier for each taxpayer, the government can more effectively track income, expenditures, and tax payments.

- Facilitation of tax processes: The NPWP simplifies various tax-related processes, such as filing tax returns, paying taxes, and claiming refunds. It ensures that all transactions are accurately recorded and attributed to the correct taxpayer.

- Legal requirement: Possessing an NPWP is a legal requirement for individuals and businesses engaged in taxable activities.

- Access to financial services: Many financial institutions in Indonesia require an NPWP for opening bank accounts, applying for loans, and conducting other financial transactions. It is also essential for participating in government tenders and contracts.

- Avoidance of higher tax rates: Taxpayers without an NPWP may be subject to higher tax rates. For instance, individuals without an NPWP may face higher withholding taxes on certain types of income, such as dividends and interest.

- Enhanced credibility: For business organizations, an NPWP is often perceived as a mark of legitimacy. It signals to partners, clients, and financial institutions that the company complies with tax laws, thereby enhancing its credibility and reputation.

Criteria for foreigners requiring an NPWP

For foreigners, holding an NPWP is mandatory for several reasons. It allows income earnings, opening bank accounts, and the purchase of property. The tax ID number is also needed to report annual taxes to Indonesian authorities.

- Tax residency status: A foreigner is considered a tax resident if they reside in Indonesia for more than 183 days within 12 months or if they intend to reside in Indonesia.

- Income from Indonesian sources: Foreigners who earn income from Indonesia, whether through employment, business activities, or other means, should obtain an NPWP. This includes income from investments, rental properties, and other local sources.

- Employment: Foreigners employed by Indonesian companies or organizations typically need an NPWP. Employers usually assist in the registration process as part of the employment contract.

Also Read: Choosing Cloud Payroll vs Payroll Outsourcing in Indonesia

Payroll software with tax calculator

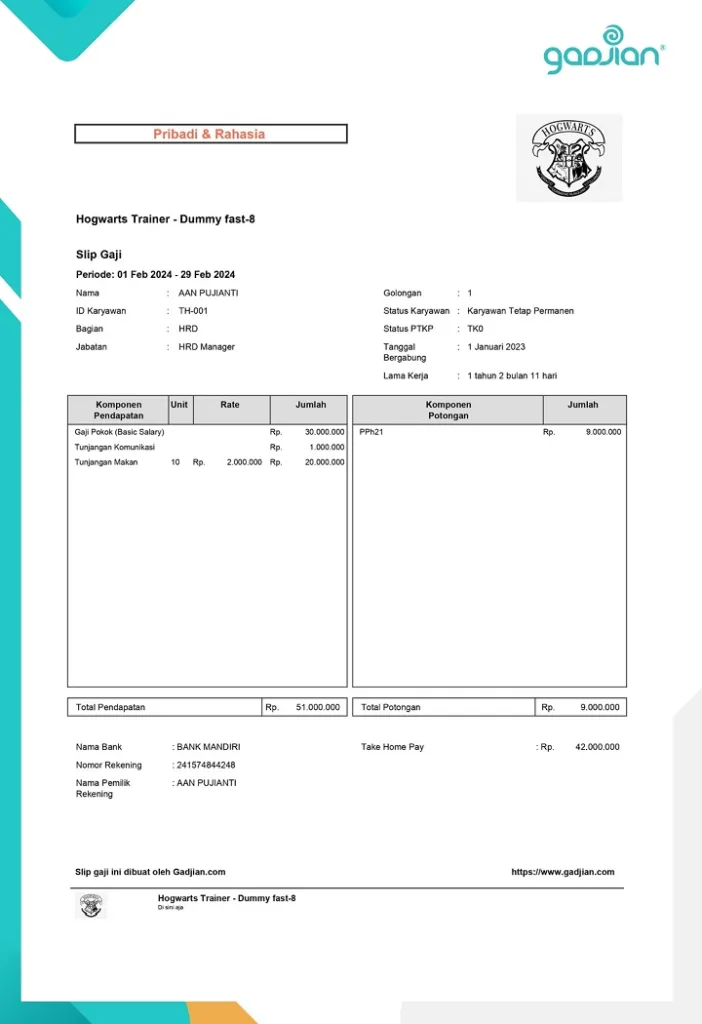

For many business organizations, calculating employee taxes can be complex, necessitating a thorough understanding of Indonesian tax regulations. Effective from January 1, 2024, the Directorate General of Taxes has introduced a new method for computing employee income tax (PPh 21). Under this updated approach, the calculation involves two distinct rates:

- Average effective rate (TER) for monthly withholding tax.

Monthly income tax = TER x Gross monthly income

- Progressive rate for annual tax calculation.

Annual income tax = Progressive rate x Annual taxable income (PKP)

The Taxable Employee Income (TER) includes 125 rates divided into three groups: A, B, and C, based on the employee’s monthly gross income and their Non-Taxable Income (PTKP) status. It’s crucial to apply the correct rate for each employee to ensure accurate tax deductions on their payslip.

To streamline the calculation of PPh 21 for employees, the most effective method is using Gadjian payroll software. This web-based payroll system features an employee tax calculator specifically designed for monthly tax calculations using the TER rate, as well as annual tax calculations using the progressive rate. By automating these calculations, Gadjian helps minimize potential errors in tax computation.

Gadjian provides comprehensive tax calculation solutions for permanent employees, non-permanent employees, and experts alike. This cloud-based payroll app also handles PPh 26 tax calculations for foreign employees or expatriates. When computing PPh 26, Gadjian applies a 20% rate on gross income as per tax regulations or rates outlined in Double Taxation Avoidance Agreements (tax treaty).

By leveraging Gadjian, organizations can efficiently manage employee payroll administration. The software automates the calculation of payslips and all associated components, ensuring compliance with government regulations. This includes overtime, holiday allowances (THR), and contributions to employment social security and health insurance (BPJS).

For anyone with a basic understanding of Indonesia’s labor, tax system, and wage regulations, Gadjian is a comprehensive solution. This HRD cloud software not only helps you complete your work faster but also ensures your company’s legal compliance in paying employee compensation.

Sumber

- UU No. 7 Tahun 2021 tentang Harmonisasi Peraturan Perpajakan. JDIH Kemenkeu. ↩︎

- Perpres No. 83 Tahun 2021 tentang Pencantuman dan Pemanfaatan NIK dan/atau NPWP dalam Pelayanan Publik. JDIH Kemenkeu. ↩︎

- PMK No. 112 Tahun 2022 tentang NPWP bagi WP Pribadi, WP Badan, dan WP Instansi Pemerintah. JDIH Kemenkeu. ↩︎