It is not enough to have a work permit in the form of a Foreign Worker Utilization Plan (RPTKA) if you intend to employ expatriates; you must also ensure that the prospective worker gets a stay permit in Indonesia.

Before working for your company in Indonesia, they must hold a Limited Stay Permit (ITAS) as they cannot work using a Visit Stay Permit (ITK).

Foreigners who have obtained ITAS for the duration specified by the Limited Stay Visa (VITAS) from the Directorate General of Immigration will receive a Limited Stay Permit Card (KITAS) in the form of an electronic (virtual) document and a printed card. KITAS holder can reside and work in Indonesia for a limited time.

Immigration Documents for Foreign Workers: Visa, Stay Permit, Stay Permit Card

Employers and foreign workers should know the difference between Indonesian immigration documents for working: visa, stay permit, and stay permit card. As an employer, you will be the guarantor of the foreign national you bring to Indonesia and be involved in processing the above requirements.

If your prospective employee is a foreigner who has never visited Indonesia, they can only apply for a visa as a document to enter the country. Stay permits and stay permit cards are only available once the expats reside in Indonesia. The type of visa will determine what activities they can do in Indonesia and the length of stay allowed.

Working Visa

To live and work as a contract employee, an expat must hold a VITAS as a working visa. According to the Minister of Law and Human Rights Regulation No. 22 of 20231 on Visa and Stay Permits, VITAS is applicable for activities such as:

- Experts;

- Workers;

- Joining to work on ships, floating devices, or installations operating in Indonesian territorial waters, territorial seas, or continental shelves, as well as the Indonesian Exclusive Economic Zone;

- Clergy;

- Foreign investment involving foreigners for up to 2 (two) years, 5 (five) years, or 10 (ten) years;

- Scientific research;

- Education;

- Family reunification;

- Repatriation of former Indonesian citizens and descendants of former Indonesian citizens up to the second degree;

- Second home;

- Medical treatment;

- Working holiday.

Previously, employers or prospective foreign experts/workers could apply for a working visa (C312) through the TKA Online website. However, starting July 22, 2024, they should apply for a working visa through e-visa imigrasi website.

The latest requirements for applying for a working visa include a letter from the guarantor, which is you as the employer, and a work permit from the Ministry of Manpower or an approved RPTKA document. Additionally, prospective foreign workers must prove that they have living expenses in Indonesia of at least USD 2,000.

Also Read: How to Register Employee with BPJS Ketenagakerjaan

ITAS: Limited Stay Permit for Work

If prospective employees hold a VITAS, they can enter Indonesia using such a visa. After arrival in Indonesia, they will receive ITAS according to their visa period, which is 180 days (6 months), 1 (one) year, or 2 (two) years. This limited stay permit is extendable for a maximum period similar to the initial period. The total ITAS duration is up to 6 (six) years.

Thus, a visa is an immigration document that serves as the basis for the Indonesian Government to grant a stay permit to its holder. Foreign workers can obtain an ITAS upon arrival in Indonesia using a VITAS. Immigration officers will conduct an inspection and verification at the Immigration Checkpoint (TPI), including fingerprinting and photography.

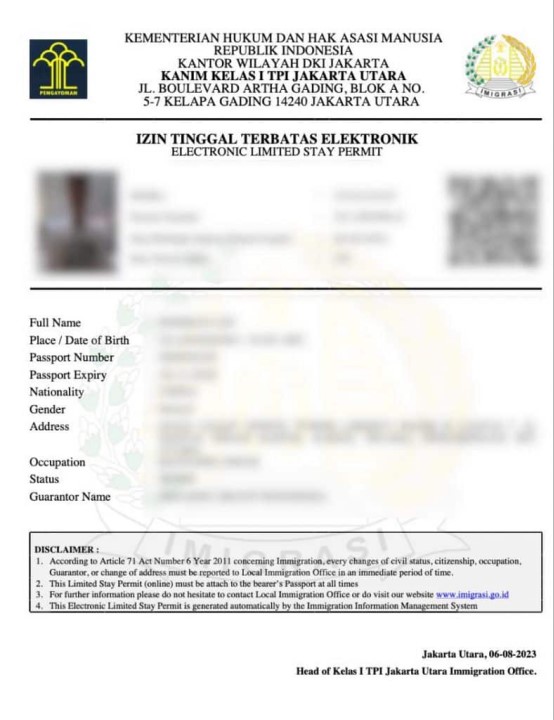

The image below is an example of ITAS.

KITAS holder: Limited Stay Permit Card for Work

Any foreign national holding ITAS will receive a KITAS card from the Directorate General of Immigration. Here is how to obtain KITAS holder for Foreign Workers:

- The employee or you as their guarantor can apply for KITAS Indonesia at the Immigration Office.

- The limited stay permit application can also be submitted after they are in Indonesia, according to PP No. 48 of 20212, no later than 30 days after arrival or after getting the immigration Entry Mark.

- If the application exceeds the time, the Immigration Office will charge a penalty fee according to regulations. However, this rule does not apply to foreigners who have received an Entry Mark as ITAS at the Immigration Checkpoint upon arrival in Indonesia.

- Attach the following requirements:

- A valid passport;

- Recent color photograph;

- Sponsor or guarantor letter from the employer;

- Approved RPTKA copy;

- Health certificate from an Indonesian hospital/clinic;

- Insurance policy or social security membership;

- Completed application form;

- Pay the KITAS holder fee to the designated bank as Non-Tax State Revenue. Here are the working KITAS prices, quoted from the website of the Directorate General of Immigration of Indonesia:

- ITAS on arrival: Rp750,000

- ITAS for up to 6 months: Rp1,000,000

- ITAS for up to 1 year: Rp1,500,000

- ITAS for up to 2 years: Rp2,000,000

- ITAS for up to 5 years (Special Economic Zones): Rp5,000,000

- The Head of the Immigration Office or the appointed immigration officer will examine the requirements. Once those are complete and correct, the officer will take a photograph and biometric examination of the foreigner.

- The Immigration Office will issue the ITAS within 4 (four) working days and provide the virtual and printed KITAS. The printed KITAS will be issued no sooner than 3 (three) working days after the stay permit is issued.

Why Convert VITAS to KITAS?

You should note that VITAS is not the same as KITAS. VITAS is an immigration document enabling a foreigner to enter and stay in Indonesia for a certain period and only for a single use. If the visa holder leaves Indonesia before the expiry date, it automatically becomes invalid and cannot be used again.

On the other hand, KITAS is a stay permit card for a certain period with multiple uses. KITAS holders can enter and leave Indonesia whenever they want as long as their stay permit is valid. KITAS can also be used to apply for a residence certificate (SKTT) at the civil registry office (Dukcapil) and as a supporting document for foreigners to purchase a personal vehicle in their name.

If your prospective foreign employee has converted their work VITAS into KITAS, they can use it to work in Indonesia. So you can legally employ them.

Also Read: Employment Types in Indonesia: Contracts and Regulations

Working KITAS

Note that not all types of KITAS are applicable for working purposes. According to the regulation, there are two kinds of KITAS holder : working KITAS and non-working KITAS. Work KITAS is for foreign workers (employees and experts), while non-working KITAS is for students, researchers, repatriates, and retirees.

If foreigners intend to work in your company, they should apply for VITAS and working KITAS. The cardholder should extend KITAS before the expiry to avoid overstay and penalty.

Working KITAS renewal conditions:

- Renewal application of KITAS valid for up to 1 (one) year is no earlier than 30 days before KITAS expires.

- Renewal application of KITAS valid for more than 1 (one) year is no earlier than 3 (three) months before KITAS expires.

- A renewal application and payment submitted before the KITAS expiry (even if the process in the Immigration Office exceeds the card validity period) is not considered overstayed.

- The renewal period is the same as the first KITAS period, with the total stay period not exceeding 6 (six) years.

- The renewal fee is the same as the first KITAS issuance fee.

Example of Working KITAS

The above image is a working KITAS holder document sample issued by the Directorate General of Immigration. In addition to the holder’s photo, the card contains information such as:

- Foreign National Identification Number (NIORA). It is 11 or 12 unique alphanumeric digits issued by the Ministry of Law and Human Rights.

- The holder identification. It includes full name, nationality, date of birth, gender, and signature.

- Permit Number as the work permit number issued by the Ministry of Manpower. This number is also used for a Taxpayer Identification Number (NPWP) registration if the holder becomes a domestic taxpayer.

- KITAS holder expiration date.

Also Read: NPWP: Key to Tax Compliance in Indonesia

Managing Foreign Employee Payroll Administration with HR & Payroll Software

Managing foreign employees is similar to managing contract employees because they work for limited positions and periods. To simplify administrative management, such as BPJS registration and reporting, salary calculation, and income tax calculation, you need the Gadjian payroll app.

Gadjian is a user-friendly web-based payroll application with main features for calculating employee salaries, whether for permanent employees, contract employees, foreign workers, daily workers, or experts. This software can automatically compile and calculate pay slips and their components accurately.

In addition to the salary calculator, this cloud payroll has a PPh 21/26 calculator that simplifies the calculation of your workers’ income tax. Gadjian computes PPh 21 for domestic taxpayers and PPh 26 for foreign taxpayers automatically. Thus, you do not need to worry about complicated tax regulations. Gadjian will calculate pay slips and their tax deductions according to recent regulations.

Gadjian app also accommodates PPh 26 tax calculations based on the tax treaty (P3B) for foreign workers from partner countries who hold a certificate of domicile (SKD) or certificate of residence (CoR). PPh 26 is the Indonesian tax for foreign income earned from working in the country for no more than 183 days.

This online HRIS software also helps you to manage employee databases centrally in one application. In the online database, you have real-time employee data, such as personal information, career details, payroll records, attendance records, and leave quotas. If you employ contract employees (PKWT), Gadjian will also notify you of the contract expiry.

Gadjian also provides Pegawe, a payroll outsourcing service, if you do not have the time and resources to manage payroll independently. You can entrust the work of calculating pay slips, BPJS registration and administration, recording employee attendance, and calculating PPh 21/26 tax to us. Our services adopt payroll rules in Indonesia, so we help your company avoid violations against labor, wage, and tax regulations.

Sumber