Understanding employment law in Indonesia is crucial. It helps new domestic companies and foreign investments within the country ensure compliance.

An essential aspect you should know before hiring is the types of employment, which determine the working relationship model, the employees to recruit, the types of employment contracts, the kinds of compensation to pay, work hours, and termination procedures. Here are the common employment types in Indonesia.

Employment Types in Indonesia

Permanent Employment

These jobs typically involve persistent administrative or core business activities and are not limited by time. Such positions exist until the company closes or ceases operations.

For these roles, companies must establish an indefinite-term employment contract (PKWTT – Perjanjian Kerja Waktu Tidak Tertentu) and hire permanent employees. Permanent jobs typically involve 7 or 8 hours of work per day and 40 hours per week.

Permanent employees enjoy comprehensive rights, including salary, allowances, holiday bonuses (THR), leave, and other benefits. They usually receive monthly salaries.

The employer-employee relationship is indefinite and only terminates upon employee retirement, death, or resignation. According to Indonesian Labor Law No. 13/20031, if the company intends to terminate employment, it must follow the legal mechanisms and procedures for Termination of Employment (PHK) as per Indonesian law.

Compensation for termination includes severance pay and service appreciation pay calculated based on the length of service.

Also Read: How to Register Employee with BPJS Ketenagakerjaan

Temporary Employment

These jobs are not indefinite but limited by time. Examples include projects lasting up to 5 years, trial projects, seasonal work, or one-time tasks.

For such positions, a fixed-term employment contract (PKWT – Perjanjian Kerja Waktu Tertentu) is made and written in Bahasa Indonesia, allowing companies to hire non-permanent employees. PKWT contracts must specify their duration: how long they last, when they begin, and when they end.

Contract employees have fewer rights compared to permanent employees. For instance, they may not receive several allowances, employee loans, company facilities, or other benefits. Contract employees typically receive monthly wages.

Employment ends upon the expiry of the contract term specified in the agreement. The contract will end once the employee accomplishes the agreed job before the contract period. Upon the expiration of a PKWT contract, companies must provide compensation equivalent to one month’s salary for each year of service, prorated.

Daily Irregular Work

These jobs are irregular in terms of work volume and timing. For example, a job might be available one day but not the next, or it might vary in workload daily.

For such jobs, companies may create daily contracts and hire daily workers. These workers are paid daily wages based on the number of days worked in a month. They do not receive payment for days they do not work.

Daily workers are limited to working less than 21 days a month. If a daily worker works 21 days or more a month for three consecutive months, they automatically become permanent employees.

Daily workers do not receive allowances or other benefits. Their daily wage is usually their sole compensation.

Also Read: The Benefits of Using Payroll Outsourcing Services in Indonesia

Part-Time Jobs

Part-time jobs involve working fewer than 7 hours daily, which means employees work less than 35 hours per week. Examples include private tutors, cafe and restaurant servers, and tour guides.

Companies may create part-time employment contracts and hire part-time employees. Part-time employee payment is per hour wages, so their monthly salary equals the hourly rate multiplied by the number of hours worked.

Flexible Work

Flexible employment is performed without an employer-employee relationship but rather as a relationship between a freelancer and a client. Freelancers are self-employed and free to accept jobs or projects from multiple clients.

These jobs often involve creative services such as writing, translation, illustration, animation, photography/videography, software testing, web development, UI/UX, and others. Employers may provide contracts specifying job requirements, completion terms, prices, and deadlines.

Flexible work is generally flexible in terms of time and location. Freelancers can do flex jobs anywhere and anytime to meet agreed deadlines. Freelancers do not receive regular salaries or wages for their services but fees calculated per unit of work.

Independent Contracts

Independent contract jobs are one-time projects performed by independent contractors, compensated based on the entire project’s scope. Employers offer desired job types, and contractors calculate total costs. The two parties should agree with a contract on job specifications, costs, completion timelines, and penalties for breach of contract.

Some example jobs are construction projects, electrical network installations, office interior design, or similar one-time projects. Agreed-upon costs are final, without additional charges, placing the risk of cost overruns on the contractor.

Outsourcing

The outsourcing service is another employment types in Indonesia Labor Law. Outsourcing involves delegating tasks from a client company to a labor provider company. Typically, outsourcing jobs relate to activities outside the core business operations, such as payroll, recruitment, security, and janitorial services.

Also Read: 25 Perusahaan Outsourcing Terbaik, Apa Saja?

Client companies enter into outsourcing contracts with outsourcing companies. Subsequently, the outsourcing company recruits temporary employees and places them at the client company. In return, the client company pays the outsourcing company according to the contract agreement, while the outsourcing company pays the salaries of the recruited employees.

Expert Services

Many companies need consulting services for specific jobs, such as organizational development, talent management, or technical work related to company activities. This work fits with experienced individuals with certified expertise and are not internal company employees.

Experts may come from consulting companies or work independently. Companies that need services should offer professional contracts regarding the type of work and fees to experts. Their relationship is not employer and employee but client and experienced service provider.

Also Read: NPWP: Key to Tax Compliance in Indonesia

HRIS Software for Managing Employee Administration

If your company employs several types of workers, there are employment types in Indonesia such as permanent employees, temporary employees, daily workers, freelancers, and experts, you should consider using Gadjian HRIS payroll software.

Gadjian is a digital solution for small, medium, and large companies needing efficient, time-saving, and error-free payroll management. This Indonesian payroll software offers payroll systems management according to the latest labor, wage, and tax laws.

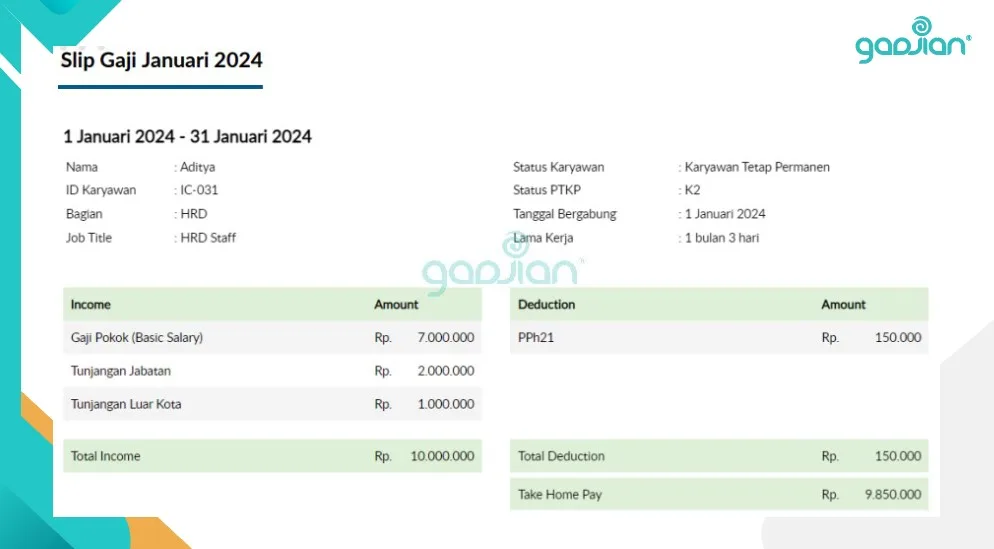

This web-based payroll will automatically calculate all types of compensation for permanent employees, contract workers, daily workers, freelancers, and experts. Calculating payslip components, such as salaries, wages, allowances, fees, bonuses, and various other types of payments, becomes simple.

Gadjian computes payslips for income based on units of time, such as monthly salary, weekly salary, daily wage, and hourly wage, or payment based on units of work. The payslip calculation includes income tax withholding according to the latest PPh 21/26 rules.

This cloud HRIS application also features personnel data management to store employee data ranging from personal data, career data, payroll details, attendance records, leave allowances, CVs, and contract documents. If you have a temporary employee, this application will notify you one month before the contract expiration.

The centralized database in one application makes it easier for HR to manage. With real-time data, employee data updates are saved and take effect immediately. For example, an approved leave request will automatically deduct the employee’s remaining annual leave. No manual deduction is necessary.

Gadjian is also an employee performance review application that allows you to manage KPIs, from creating templates as needed to assist in the KPI cycle in real-time, providing feedback, and publishing assessment results.

In addition, Gadjian is an ATS-based employee recruitment application. Besides tracking applicants, the module allows you to create a centralized candidate database, monitor selection stages, collaborate with recruiters, post free job advertisements, and accept applications online.

If your company has a limited team focusing on core business activities and does not want to manage employee payroll administration, consider using our payroll and HR outsourcing services: Pegawe.

We will handle employee payroll administration, income tax PPh 21/26, registration and calculation of BPJS labor and health social security contributions, employee attendance, and personnel data management for you. We also provide consulting services on employee termination processes and procedures under the law.

Sumber