Peraturan Hukum Ketenagakerjaan

Ada dua peraturan hukum ketenagakerjaan yang berlaku di Indonesia saat ini, yaitu UU No 13 Tahun 2003 tentang Ketenagakerjaan dan UU No 6 Tahun 2023 tentang Penetapan Perppu Cipta Kerja Menjadi UU, atau juga disebut UU Cipta Kerja 2023.

Pada dasarnya, UU Cipta Kerja terbaru Bab IV Ketenagakerjaan merupakan revisi dari UU No 13 Tahun 2003, tetapi tidak seluruhnya. Sehingga, pasal-pasal di UU No 13 Tahun 2003 yang tidak disebut dalam UU No 6 Tahun 2023 tetap berlaku.

Berdasarkan payung hukum tersebut, pemerintah menerbitkan aturan pelaksanaan UU, dari Peraturan Pemerintah sampai dengan Peraturan Menteri.

A. Aturan Pengupahan di IndonesiaPeraturan pengupahan tercantum di UU No 6 Tahun 2023, Bab IV Pasal 81 Angka 27, tentang perubahan Pasal 88 UU No 13 Tahun 2003.

Pokok aturan di UU Ketenagakerjaan terbaru itu adalah bahwa setiap pekerja berhak atas penghidupan yang layak bagi kemanusiaan, sehingga pemerintah pusat menetapkan kebijakan pengupahan sebagai salah satu upaya mewujudkan hak pekerja tersebut. Kebijakan pengupahan yang dimaksud meliputi:

- Upah minimum;

- Struktur dan skala upah;

- Upah kerja lembur;

- Upah tidak masuk kerja dan/atau tidak melakukan pekerjaan karena alasan tertentu;

- Bentuk dan cara pembayaran upah;

- Hal-hal yang dapat diperhitungkan dengan upah;

- Upah sebagai dasar perhitungan atau pembayaran hak dan kewajiban lainnya.

Pokok-pokok aturan itu diuraikan lebih rinci di dalam Peraturan Pemerintah No 36 Tahun 2021 tentang Pengupahan, yang merupakan aturan pelaksanaan UU Cipta Kerja.

1. Upah Minimum

Setiap pengusaha dilarang membayar upah karyawan di bawah ketentuan upah minimum yang berlaku. Upah minimum menjadi standar terendah dalam sistem pengupahan di Indonesia, dan hanya berlaku untuk karyawan dengan masa kerja kurang dari 1 tahun. Sedangkan upah karyawan dengan masa kerja 1 tahun atau lebih berpedoman pada struktur dan skala upah.

Aturan upah minimum terbaru terdapat di PP No 51 Tahun 2023 tentang Perubahan PP Pengupahan. Ada dua jenis upah minimum, yaitu upah minimum provinsi (UMP) dan upah minimum kabupaten/kota (UMK).

Penyesuaian upah minimum dilakukan setiap tahun oleh gubernur menggunakan formula penghitungan upah minimum dengan mempertimbangkan variabel pertumbuhan ekonomi, inflasi, dan indeks tertentu. Formulanya seperti berikut:

UM (t) merupakan upah minimum tahun berjalan, UM (t+1) merupakan upah minimum tahun depan, PE merupakan pertumbuhan ekonomi, dan α merupakan indeks kontribusi tenaga kerja terhadap pertumbuhan ekonomi daerah, berkisar dari 0,10 sampai dengan 0,30.

Penetapan UMP dilakukan setiap 21 November dan UMK setiap 30 November. Upah minimum tersebut berlaku di masing-masing daerah mulai 1 Januari tahun berikutnya.

Ketentuan upah minimum dikecualikan bagi usaha mikro dan usaha kecil, di mana upah pekerjanya ditetapkan berdasarkan kesepakatan, dengan ketentuan paling sedikit 50% dari rata-rata konsumsi masyarakat di provinsi atau 25% di atas garis kemiskinan di provinsi.

2. Struktur dan Skala Upah

Struktur dan skala upah adalah susunan tingkat upah dari yang terendah sampai yang tertinggi atau sebaliknya, yang memuat kisaran nominal upah dari yang terkecil sampai yang terbesar untuk setiap golongan jabatan. Sedangkan golongan jabatan adalah pengelompokan jabatan berdasarkan nilai atau bobot jabatan.

Menurut UU No 6 Tahun 2023, Pasal 81 Angka 33, tiap pengusaha wajib menyusun struktur dan skala upah dengan memperhatikan kemampuan perusahaan dan produktivitas. Struktur dan skala upah digunakan sebagai pedoman pengusaha dalam menetapkan upah pekerja, dan wajib diberitahukan ke setiap pekerja secara perorangan.

Ketentuan dan cara menyusun struktur dan skala upah dapat dilihat di PP Pengupahan dan Peraturan Menteri Ketenagakerjaan No 1 Tahun 2017 tentang Struktur dan Skala upah.

Pelajari contoh cara menyusun struktur dan skala upah!

3. Upah Lembur

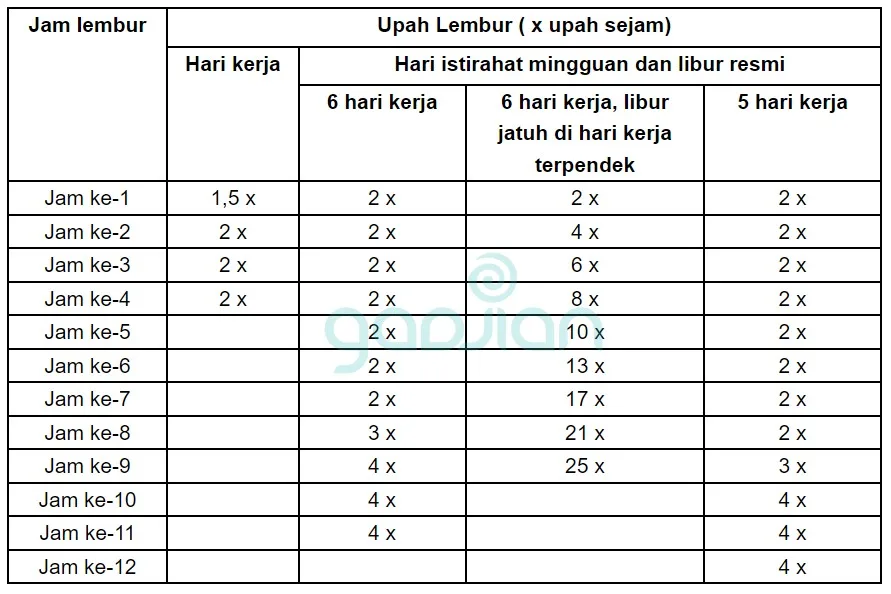

Upah kerja lembur dihitung menggunakan upah sejam yang didasarkan pada upah sebulan. Upah sejam yaitu 1/173 kali upah sebulan (gaji pokok dan tunjangan tetap). Ketentuan upah lembur per jam diatur dalam PP No 35 Tahun 2021. Berikut ini rumusnya dalam tabel:

Pahami contoh perhitungan lembur terbaru!

4. Upah Tidak Masuk Kerja

UU Ketenagakerjaan mengatur bahwa upah tidak dibayar apabila karyawan tidak melakukan pekerjaan. Namun, apabila karyawan tidak masuk kerja karena alasan berikut ini, maka pengusaha tetap wajib membayar upahnya:

- Karyawan sakit sehingga tidak dapat melakukan pekerjaan;

- Karyawan perempuan sakit pada hari pertama dan kedua masa haid, sehingga tidak dapat melakukan pekerjaan;

- Karyawan tidak masuk bekerja karena menikah, menikahkan, mengkhitankan, atau membaptiskan anaknya, istri melahirkan atau keguguran kandungan, suami/istri/anak/menantu/orang tua/mertua/anggota keluarga dalam satu rumah meninggal dunia;

- Karyawan tidak dapat melakukan pekerjaannya karena sedang menjalankan kewajiban terhadap negara;

- Karyawan tidak dapat melakukan pekerjaannya karena menjalankan ibadah yang diperintahkan agamanya;

- Karyawan bersedia melakukan pekerjaan yang telah dijanjikan tetapi pengusaha tidak mempekerjakannya, baik karena kesalahan sendiri maupun halangan yang seharusnya dapat dihindari pengusaha;

- Karyawan melaksanakan hak istirahat;

- Karyawan melaksanakan tugas serikat pekerja atas persetujuan pengusaha;

- Karyawan melaksanakan tugas pendidikan dari perusahaan.

Kontrak kerja atau perjanjian kerja adalah suatu perjanjian antara pekerja dan pengusaha secara lisan dan/atau tertulis, baik untuk waktu tertentu maupun waktu tidak tertentu, yang memuat syarat-syarat kerja serta hak dan kewajiban pekerja dan perusahaan.

Melalui kontrak kerja, dapat diketahui status hubungan kerja karyawan dan pengusaha. UU No 6 Tahun 2023 Pasal 81 Angka 12 sampai 16 menjelaskan jenis kontrak kerja dan status hubungan kerja, yaitu:

1. Perjanjian Kerja Waktu Tertentu (PKWT)

PKWT adalah perjanjian kerja tertulis antara karyawan dan pengusaha untuk mengadakan hubungan kerja dalam jangka waktu tertentu atau untuk pekerjaan tertentu.

Jangka waktu PKWT paling lama adalah 5 tahun, termasuk perpanjangan kontrak, dan tidak boleh ada masa percobaan kerja (probation). Karyawan PKWT berstatus karyawan kontrak.

Hubungan kerja berakhir pada saat selesainya jangka waktu kontrak atau selesainya pekerjaan yang diperjanjikan. Saat hubungan kerja berakhir, pengusaha wajib membayar uang kompensasi PKWT kepada karyawan kontrak, yang perhitungannya diatur dalam PP No 35 Tahun 2021.

PKWT tidak dapat diadakan untuk pekerjaan yang sifatnya tetap dan terus-menerus, melainkan hanya untuk pekerjaan yang sifatnya sementara, sekali selesai, atau musiman. Mengenai jenis-jenis pekerjaan PKWT dan aturan karyawan kontrak dapat dilihat di PP tersebut.

Lihat contoh dan cara membuat kontrak kerja!

2. Perjanjian Kerja Waktu Tidak Tertentu (PKWTT)

PKWTT adalah perjanjian kerja antara karyawan dan pengusaha untuk mengadakan hubungan kerja yang tidak dibatasi waktu untuk pekerjaan yang sifatnya tetap dan terus-menerus. Karyawan PKWTT berstatus karyawan tetap atau permanen.

Dalam PKWTT, pengusaha boleh mensyaratkan masa percobaan kerja dengan waktu paling lama 3 bulan. Apabila percobaan kerja dilakukan lebih dari 3 bulan, maka status karyawan otomatis berubah menjadi karyawan tetap pada bulan ke-4.

Hubungan kerja PKWTT hanya dapat berakhir melalui pemutusan hubungan kerja, baik yang dilakukan oleh pengusaha atau karyawan. Dalam hal terjadi PHK, pengusaha wajib membayarkan pesangon, uang penghargaan masa kerja, uang pisah, dan uang penggantian hak, yang diatur UU.

Cek daftar tanya jawab UU Cipta Kerja seputar perjanjian kerja!

3. Perjanjian Kerja Harian

Perjanjian kerja harian diatur dalam PP No 35 Tahun 2021, Pasal 10, yaitu PKWT yang diadakan untuk pekerjaan tertentu yang jenis dan sifat atau kegiatannya tidak tetap, berubah-ubah dalam hal waktu dan volume pekerjaan, serta pembayaran upah pekerja didasarkan pada kehadiran. Status pekerja adalah pekerja lepas harian.

Perjanjian ini harus memenuhi ketentuan, yakni jumlah hari kerja kurang dari 21 hari dalam sebulan. Apabila hari kerjanya 21 hari atau lebih dalam sebulan selama 3 bulan berturut-turut, maka hubungan kerja berubah menjadi PKWTT dan status pekerja menjadi karyawan tetap.

4. Perjanjian Alih Daya (Outsourcing)

Alih daya adalah penyerahan sebagian pekerjaan kepada perusahaan lainnya. Perjanjian alih daya adalah kontrak tertulis yang diadakan pengusaha dengan perusahaan penyedia pekerja outsourcing, berdasarkan kebutuhan penggunaan tenaga kerja untuk waktu tertentu.

Status pekerja outsourcing adalah karyawan dari perusahaan penyedia alih daya yang merekrut mereka, bukan karyawan dari perusahaan pengguna, sehingga hak, kesejahteraan, dan pembayaran upah menjadi tanggung jawab perusahaan alih daya.

Selain UU No 6 Tahun 2023, ketentuan mengenai alih daya juga diatur di PP No 35 Tahun 2021.

Simak contoh perjanjian alih daya disini!

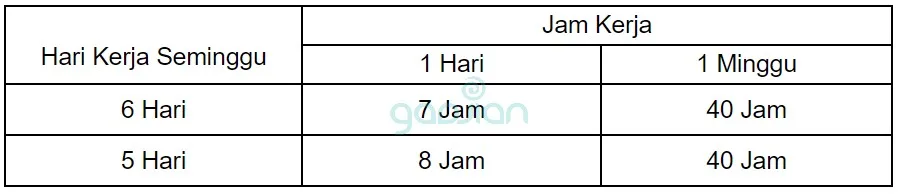

C. Waktu Kerja dan Waktu IstirahatSetiap perusahaan dapat memiliki aturan jam kerja atau hari kerja sendiri, namun jumlah waktu kerja harus sesuai dengan UU. Waktu kerja ditetapkan oleh pemerintah dalam UU No 6 Tahun 2023 Pasal 81 Angka 23.

Ketentuan waktu kerja di atas tidak berlaku bagi sektor usaha atau pekerjaan tertentu yang diatur.

1. Jam Kerja dan Jam Lembur

Jam kerja menurut aturan ketenagakerjaan terbaru dibedakan menjadi 4 jenis, yaitu:

- Jam kerja tetap

- Jam kerja paruh waktu

- Jam kerja fleksibel

- Jam kerja shift

Jam kerja adalah waktu untuk melakukan pekerjaan, bisa siang hari dan/atau malam hari. Perusahaan dapat membuat jadwal kerja dan aturan mulai dan berakhirnya jam kerja sesuai dengan kebutuhan perusahaan, yang diatur dalam perjanjian kerja, peraturan perusahaan, atau perjanjian kerja bersama.

Apabila pengusaha menginginkan karyawan bekerja melebihi jam kerja, maka sesuai Pasal 81 Angka 24, harus memenuhi dua syarat, yaitu memperoleh persetujuan karyawan dan menghitungnya sebagai kerja lembur dan membayar upah lembur sesuai ketentuan pemerintah.

Aturan lembur terbaru di UU No 6 Tahun 2023 menyebutkan jumlah jam kerja lembur di perusahaan swasta paling lama 4 jam dalam sehari dan 18 jam dalam seminggu. Jumlah itu tidak termasuk lembur pada waktu istirahat mingguan atau hari libur nasional.

Lihat aturan jam kerja perusahaan swasta terbaru!

2. Istirahat dan Cuti

Ketentuan waktu istirahat diatur dalam Pasal 81 Angka 25 yang menyebutkan pengusaha wajib memberikan waktu istirahat dan cuti. Waktu istirahat diberikan di antara jam kerja, paling sedikit setengah jam setelah karyawan bekerja 4 jam terus-menerus, dan tidak dihitung sebagai waktu kerja. Selain itu, karyawan juga berhak mendapat istirahat mingguan paling sedikit 1 hari dalam seminggu.

Baca tanya jawab seputar istirahat kerja!

Sedangkan cuti tahunan merupakan hak istirahat karyawan yang wajib diberikan paling sedikit 12 hari kerja setelah karyawan bersangkutan bekerja selama 12 bulan secara terus-menerus.

Pelaksanaan cuti tahunan diatur dalam perjanjian kerja, peraturan perusahaan, atau perjanjian kerja bersama.

Selama menjalankan hak istirahat dan cuti, karyawan bersangkutan tetap berhak mendapat upah penuh.

Lihat ulasan seputar jenis dan hak cuti karyawan menurut UU terbaru.

Hak istirahat atau cuti juga wajib diberikan kepada karyawan karena alasan berikut:

- Melahirkan atau keguguran kandungan;

- Sakit dan tidak dapat melakukan pekerjaan;

- Cuti atau izin karena alasan penting, yang diatur di Pasal 93 ayat (2) UU Ketenagakerjaan No 13 Tahun 2003.

3. Izin Sakit

Apabila karyawan tidak dapat melakukan pekerjaannya karena sakit, pengusaha tetap wajib membayar upahnya. Namun, karyawan yang sakit dan tidak masuk kerja selama 2 hari berturut-turut atau lebih harus menyertakan surat keterangan sakit dari dokter. Jika tidak, karyawan dianggap mangkir dan dapat mengurangi jatah cuti tahunan.

Apabila sakit yang diderita karyawan cukup parah, misalnya akibat kecelakaan kerja atau penyakit karena pekerjaan yang membutuhkan waktu pemulihan yang tidak pasti, maka pengusaha melakukan penyesuaian upahnya, dengan ketentuan 100% untuk 4 bulan pertama, 75% untuk 4 bulan kedua, 50% untuk 4 bulan ketiga, 25% untuk bulan selanjutnya, dan pengusaha boleh melakukan PHK.

UU Ketenagakerjaan memberikan batas izin sakit sampai dengan 12 bulan. Apabila belum melampai batas waktu ini, pengusaha tidak boleh melakukan PHK karena alasan sakit.

D. Pemutusan Hubungan KerjaPemutusan hubungan kerja (PHK) adalah pengakhiran hubungan kerja karena suatu hal tertentu yang mengakibatkan berakhirnya hak dan kewajiban antara pengusaha dan karyawan.

PHK tidak dapat dilakukan secara sepihak oleh pengusaha, melainkan harus melalui mekanisme sesuai UU.

1. Mekanisme PHK

PHK hanya dapat dilakukan untuk 15 jenis alasan yang disebutkan dalam UU No 6 Tahun 2023 Pasal 81 Angka 45. Sebaliknya, pengusaha juga tidak boleh melakukan PHK dengan 10 jenis alasan yang diatur dalam Pasal 81 Angka 43.

Prosedur PHK di awali penyampaian surat pemberitahuan PHK beserta alasannya dari pengusaha. Dalam hal karyawan tidak menolak dan tidak keberatan atas surat pemberitahuan PHK, maka PHK cukup didaftarkan ke Dinas Ketenagakerjaan setempat dan pengusaha membayar kompensasi PHK sesuai ketentuan UU.

Apabila karyawan keberatan atas PHK, maka wajib membuat surat penolakan paling lama 7 hari setelah diterimanya surat pemberitahuan. Proses selanjutnya adalah perundingan bipartit, perundingan tripartit, dan lewat lembaga penyelesaian perselisihan hubungan industrial.

Berikut ketentuan PHK menurut UU terbaru!

2. Hak karyawan PHK

Pengusaha wajib membayar hak karyawan PHK berupa uang pesangon, uang penghargaan masa kerja (UPMK), uang pisah, dan uang penggantian hak. Cara menghitung uang pesangon dan UPMK diatur dalam PP No 35 Tahun 2021.

Tidak semua karyawan PHK mendapatkan hak sama, melainkan tergantung jenis alasan PHK. Contohnya, dalam kasus PHK karena karyawan mangkir, atau melakukan tindak pidana, atau mengundurkan diri atas kemauan sendiri, maka mereka tidak berhak atas pesangon dan UPMK, melainkan hanya diberikan uang pisah dan uang penggantian hak.

Pelajari perhitungan pesangon PHK terbaru!

Regulasi Ketenagakerjaan

Regulasi Ketenagakerjaan  Seputar Penggajian

Seputar Penggajian  Jaminan Sosial

Jaminan Sosial