Do you seek an expert or employee from abroad to hire for your company? Let us check if you are eligible by the national law system.

Before applying for Work Permit Requirements in Indonesia to employ expatriates, ensure you meet several requirements and conditions ruled by the recent regulations.

At least three regulations govern the use of foreign workers in Indonesia: the Omnibus Law1, especially concerning amendments to the Manpower Law No. 13 of 20032, Government Regulation No. 34 of 2021, and Minister of Manpower Regulation No. 8 of 2021.

The good news is that the government has simplified the requirements for a license to employ expatriates by eliminating the Permit to Employ Foreign Workers (IMTA) document since 2018. It means you are only required to have a Foreign Worker Utilization Plan (RPTKA) document approved by the Ministry of Manpower.

Who Can Employ Foreign Workers?

According to Government Regulation No. 34 of 20213, employers of foreign workers include:

- Government agencies, foreign diplomatic missions, and international organizations;

- Foreign trade representative offices, foreign company representative offices, and foreign news agencies operating in Indonesia;

- Foreign private companies operating in Indonesia;

- Legal entities in the form of Limited (Ltd.) companies or foundations established under Indonesian law or foreign business entities registered with the relevant authorities;

- Social, religious, educational, and cultural institutions;

- Impresario service businesses;

- Business entities that are permitted to recruit foreign workers.

So, if your organization is a foreign private company, a foreign investment company, or a domestic company, you will be eligible to employ foreign workers.

Also Read: Employment Types in Indonesia: Contracts and Regulations

Requirements for Foreign Workers to Work in Indonesia

Expats recruited to work in Indonesia must meet the eligibility stipulated in Government Regulation (PP) No 34/2021, which includes:

- Having an educational background that matches the qualifications of the job to occupy;

- Having a minimum of 5 (five) years of work experience corresponding to the position to hold;

- Must transfer their skills to Indonesian co-workers.

According to the Omnibus Law, foreigners are only allowed to work in Indonesia for specific roles determined by the Minister of Manpower and for a specified period. In other words, employing foreigners is only possible under a fixed-term employment contract (PKWT).

Before working in Indonesia, an expat must also qualify for the immigration legal requirements to obtain a stay permit document.

How to Get a Work Permit Requirements in Indonesia

Since the Omnibus Law enforcement, the provisions for work permit requirements application have become simpler, requiring only the Foreign Worker Utilization Plan (RPTKA) and the Compensation Fund for the Utilization of Foreign Workers (DKPTKA), Limited-stay Visa, and Limited-stay Permit.

Foreign Worker Utilization Plan (RPTKA)

According to Minister of Manpower Regulation No. 8 of 20214, every employer hiring foreign workers must have an RPTKA approved by the Minister of Manpower or an appointed official. The RPTKA is a plan for employing foreign workers for specific positions and periods.

The RPTKA must contain:

- your identity as the employer

- your reason for using expatriates

- the position and role of expatriates in your organization

- the number of expatriates you will hire

- the duration of employment

- location of work

- the identity of co-workers for expatriates

- your annual plan for foreign worker absorption

You can select one of these four types of RPTKA according to your necessity:

- Temporary Work RPTKA: valid for a maximum of 6 months and non-renewable for:

- making commercial films with the necessary permits;

- audits, production quality control, or inspections of company branches in Indonesia for more than one month;

- work related to machinery installation, electrical, after-sales service, or business exploration products;

- impresario services business;

- one-time or less-than-6-month work.

- Long-term RPTKA: valid for up to 2 (two) years and renewable.

- Non-DKPTKA RPTKA: valid for a maximum of 2 years and renewable, intended for employers such as government agencies, foreign diplomatic missions, international organizations, social institutions, religious institutions, and certain positions in educational institutions.

- Special Economic Zone (KEK) RPTKA: valid for up to 5 years and renewable. For director or commissioner positions, KEK RPTKA is issued once and is valid as long as they hold the position.

Here is an application process for RPTKA approval according to Minister of Manpower Regulation No. 8 of 2021:

- Submit an RPTKA approval application through the TKA Online website or tka-online.kemnaker.go.id.

- Make sure you have the information below to submit:

- Employer identity;

- Reason for using expatriates;

- Positions and roles to offer;

- Quantity of expatriates;

- Duration of employment;

- Work location;

- For RPTKA of more than 6 (six) months and KEK RPTKA, you should provide co-workers for foreigners. Add information on the identity of co-workers, the Indonesian worker absorption plan, and your commitment to appointing co-workers, providing training, and facilitating Indonesian language education for foreign workers.

- Upload your documents, including:

- RPTKA approval application letter;

- An assignment letter from the company owner;

- Your business registration number (NIB) or business license;

- Deed and approval decision of establishment and amendments;

- Proof of labor report;

- Your domicile certificate;

- A draft employment contract or other agreement; and

- Organizational structure chart.

- If the application is complete and correct, the Ministry of Manpower verifies the data and conducts an online assessment.

- The Ministry of Manpower will issue eligibility assessment results within 2 (two) working days.

- Submit data of your foreign workers through TKA Online, including:

- Personal identity;

- Position and employment duration;

- Work location;

- Insurance policy number or social security program membership number;

- Domicile code and location.

- Upload the documents of your foreign workers, including:

- Educational certificates;

- Competency certificates or work experience proof;

- Employment contracts or other agreements;

- Passport copy;

- Color photo (with red background).

- Upload these required letters:

- RPTKA approval application letter;

- Assignment or power of attorney letter from the employer;

- Application letter to the Director General of Immigration for a work visa;

- Employer’s bank statement;

- Zero Rupiah approval letter;

- Co-worker appointment letter;

- Employer’s guarantee letter.

- The Ministry of Manpower will verify your application within 2 (two) working days.

- If the submitted data is complete and correct, you will receive notification for DKPTKA payment, which amounts to US$100 per person per month as Non-Tax State Revenue (PNPB).

- After paying DKPTKA, the Ministry of Manpower issues RPTKA approval.

- Last, the Ministry of Manpower will send foreign workers’ data to the Directorate General of Immigration for visa and stay permit administrations.

Also Read: How to Register Employee with BPJS Ketenagakerjaan

Limited-Stay Visa (VITAS) and Limited-Stay Permit (ITAS)

As an employer, you can apply for a limited-stay visa for foreign workers and experts you will employ to the Directorate General of Immigration.

The requirements for applying for a Limited-Stay Visa (VITAS) according to Minister of Law and Human Rights Regulation No. 22 of 20235 on Visas and Stay Permits are:

- a valid passport with at least 6 (six) months of validity;

- guarantee proof from the employer;

- proof of sufficient funds for living expenses;

- recent color photograph;

- statement from the relevant central government agency.

VITAS Issuance Process:

- The completeness of the requirements checking;

- The payment process for visa and verification fees;

- Profiling and verification processes include background checks, application requirements, prevention and deterrence lists, subject of interest lists, immigration service history, biometric data, and data provided in the visa application;

- Approval for the Limited-Stay Visa;

- The visa is issued.

After arrival in Indonesia, your foreign workers must convert their Limited-Stay Visa into a Limited-Stay Permit (ITAS). The stay permit period aligns with VITAS, which can be 180 days (6 months), 1 (one) year, or 2 (two) years.

Requirements for Obtaining a Limited-Stay Permit Card (KITAS):

- A valid passport with at least 6 (six) months of validity;

- Recent color passport-sized photograph;

- Sponsor or guarantor letter from the employer;

- Approved RPTKA copy;

- Health certificate from an Indonesian hospital/clinic;

- Insurance policy or social security membership;

- Completed application form;

- ITAS fee payment to the designated bank as Non-Tax State Revenue

If the foreign employee enters Indonesia with a VITAS, they will receive an entry stamp from immigration officers at the entry point. Converting VITAS to KITAS needs several verification processes, including fingerprinting and photographing. After obtaining KITAS, the foreign employee must report to the local civil registry office (Dukcapil) to receive a Residence Certificate (SKTT).

Also Read: The Benefits of Using Payroll Outsourcing Services in Indonesia

Streamline Your HR Processes with Gadjian

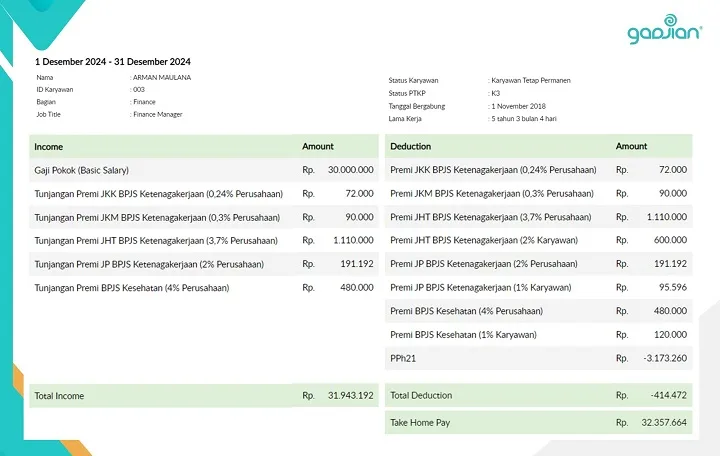

To handle the payroll of your expatriate employees and foreign experts, you can use Indonesia’s online payroll software: Gadjian.

Gadjian not only composes and calculates pay slips and their components accurately and in accordance with Indonesian labor and wage regulations, but also calculates their income tax in line with the latest tax regulations.

This payroll system is equipped with a tax calculator to automate the calculation of income tax: PPh 21 for domestic employees and PPh 26 for foreign citizens who are non-resident taxpayers.

Gadjian also accommodates the calculation of PPh 26 using tax treaty rates for employees from countries that have a double taxation avoidance agreement (P3B) with Indonesia.

This cloud-based HR application can also be used to manage employee databases, giving you a single, centralized, and real-time data source. The convenience of an online database lies in its practical storage on a cloud server, which can be accessed anytime and anywhere, even from different devices. All employee data, from personal identities to salaries, can be stored in the application.

Gadjian is also an employee performance review app that allows you to manage structured and objective employee assessments. You can set up individual and team performance evaluation cycles periodically, create assessment templates and metrics, provide feedback, and publish evaluation results. With this application, you have real-time performance data for decision-making.

We also provide Pegawe, payroll outsourcing services for those who lack the resources to manage employee payroll in accordance with Indonesian wage and labor regulations. Focus on managing your business and leave the tasks of payroll, BPJS registration and administration, income tax calculations (PPh 21/PPh 26), and employee attendance recording to us. Pegawe helps streamline your administration processes and ensures compliance with the law.

Sumber

- UU No. 6 Tahun 2023 tentang Cipta Kerja. JDIH Kemnaker. ↩︎

- UU No. 13 Tahun 2003 tentang Ketenagakerjaan. JDIH Kemnaker. ↩︎

- PP No 34 Tahun 2021 tentang Penggunaan Tenaga Kerja Asing. JDIH Kemnaker ↩︎

- Permenaker No. 8 Tahun 2021 tentang Peraturan Pelaksanaan PP No. 34 Tahun 2021 Tentang Penggunaan Tenaga Kerja Asing. JDIH Kemnaker ↩︎

- Peraturan Menteri Hukum dan HAM No. 22 Tahun 2023 tentang Visa dan Izin Tinggal. JDIH Kemnaker. ↩︎